ในปัจจุบันนี้เรื่องของการเลือกรถยนต์นั้นก็เป็นเรื่องหนึ่งที่สำคัญอย่างมากที่จะใช้ในการประกอบการตัดสินใจดังนั้นเราจึงควรที่จะต้องให้ความสำคัญกับเรื่องของการเลือกรถยนต์ให้มากๆด้วยจึงจะดีเพราะว่ายิ่งเราได้รู้จักที่จะเลือกรถยนต์ในการขับขี่ให้ตรงกับเราเองแล้วนั้นจะช่วยทำให้เรายิ่งมีความสุขอย่างที่สุดเลย หลายๆอย่างในเรื่องของการเลือกรถยนต์นั้นเราก็ควรที่จะต้องเลือกจากจำนวนสมาชิกที่เรามีก่อนเพราะถ้าหากเรามีคนมากแล้วเลือกรถคันเล็กก็ไม่เหมาะเพราะว่าอาจจะทำให้นั่งไม่พอแล้วก็ยิ่งทำให้ต้องเร่งเครื่องมากขึ้นอีกด้วย ทุกๆอย่างในตอนนี้เราจึงควรที่จะต้องให้ความสนใจกับเรื่องของรถยนต์ให้มากๆด้วยอย่างถ้าเรารู้จำนวนคนแล้วเราก็ควรที่จะต้องเลือกรถยนต์ที่ให้พอกับจำนวนสมาชิกที่เราจะนั่งด้วย เพราะถ้าหากเราเลือกจำนวนสมาชิกที่เราจะนั่งแล้วนั้นก็จะยิ่งดีอย่างมากเลยเพราะอย่างน้อยเราก็สามารถที่จะรู้รุ่นรถแล้วว่าเราควรที่จะเอารถกี่ที่นั่ง ถ้าสมาชิกสามถึงสี่คนนั้นอาจจะเป็นรถแจ้สหรือรถขนาดเล็กได้หมดเลยแต่ควรที่จะต้องเลือกกำลังเครื่องยนต์หนึ่งพันห้าร้อยซีซีขึ้นไปด้วยเพราะการที่เราเลือกเครื่องยนต์กำลังเท่านี้นั้นจะยิ่งดีต่อเราเองอย่างมากเลยในการที่จะขับรถยนต์ไปไหนมาไหนเครื่องก็จะมีแรงส่งที่ดีและไม่ต้องออกแรงเยอะหรือทำให้เปลืองน้ำมันด้วย ทุกๆอย่างในเรื่องของการเลือกรถยนต์นั้นหากเป็นสมาชิกใหญ่ที่มีหกคนก็อาจจะเลือกรถขนาดใหญ่เช่นฟอร์จูนเนอร์เพราะรถใหญ่นี้จะจุสมาชิกอย่างเพียงพอแล้วก็จะยิ่งช่วยทำให้เรานั้นขับขี่ได้อย่างไม่ต้องออกแรงมากมายเลยเพราะว่ามีกำลังเครื่องยนต์ประมาณพันแปดร้อยนั้นเอง อันนี้จะทำให้มีแรงส่งที่ดีอย่างมากมายเลยดังนั้นเราจึงควรที่จะต้องยิ่งให้ความสนใจและใส่ใจให้มากๆด้วยในเรื่องนี้เพราะยิ่งเราให้ความสนใจกับเรื่องของการเลือกเครื่องยนต์หรือรถยนต์ที่เราจะขับแล้วนั้นก็จะยิ่งเกิดเรื่องราวที่ดีๆอย่างแน่นอนทำให้เราสามารถที่จะขับรถยนต์ไปทางไกลหรือไปไหนมาไหนได้อย่างสบายใจและมีความสุขอีกด้วย การเลือกรถยนต์นั้นเป็นสิ่งที่ดีที่เราเองก็ควรที่จะต้องให้ความสนใจและควรที่จะต้องใส่ใจให้มากๆด้วยเพราะยิ่งเราใส่ใจมากเท่าไหร่แล้วนั้นเราก็จะยิ่งมีความสุขกับรถของเราด้วยเพราะทุกคนที่มีรถจะต้องใช้รถในการเดินทางเพื่อทำธุระของตัวเองกันอย่างมาก หากเราได้รับความสะดวกสบายแล้วจะดีอย่างที่สุดเลย

Posts

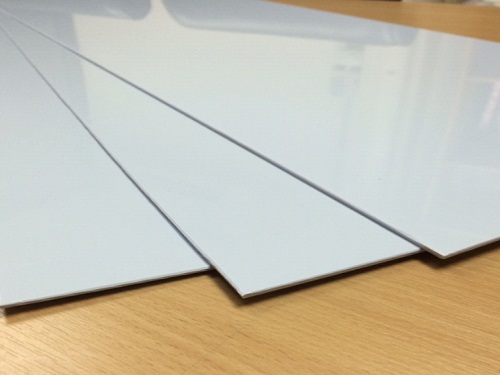

แผ่น abs แผ่น hip คืออะไร สั่งซื้อที่ไหน

แผ่น abs แผ่น hip พลาสติกทั้งสองชนิดนี้ต้องยอมรับเลยว่าได้รับความนิยมสูงมาก สามารถนำไปใช้ประโยชน์หรือประยุกต์ใช้งานได้หลากหลาย ปัจจุบันสามารถหาซื้อได้ไม่ยากเลย ส่วนจะซื้อได้จากที่ไหน เรามีแหล่งจำหน่ายดีๆ มาฝากก่อนอื่นเลยเรามาทำความรู้จักกับพลาสติกทั้งสองชนิดนี้กันก่อน มาดูว่าพลาสติกทั้งสองชนิดที่เรากล่าวถึงอยู่นี้ มีดียังไง ทำไมได้รับความนิยม แผ่น ABS แผ่น ABS ย่อมาจากคำว่า Acrylonitrile Butadiene ผลิตจากเม็ดลพาสติกสไตรีนชั้นดี คุณสมบัติที่น่าสนใจของพลาสติกชนิดนี้คือ แข็งแรง ทนทาน สามารถรองรับแรงกระแทกได้ดี หากต้องการนำมาขึ้นรูปสามารถนำมาขึ้นรูปได้ด้วยความร้อน ซึ่งขึ้นรูปได้ง่ายมาก ตัดแต่งได้ง่ายเพื่อให้เหมาะสมตามความต้องการ แผ่น ABS สามารถนำไปใช้งานได้ทั้งนอกและภายใน ปัจจุบันนิยมใช้ผลิตเป็นส่วนประกอบของ เครื่องใช้ไฟฟ้า ผนังด้านในของตู้เย็น ชิ้นส่วนหรือส่วนประกอบของยานยนต์ คอนโซล ที่ครอบล้ออะไหล่ กระจกข้างรถยนต์ ใช้ในงานตกแต่งภายใน ภายนอก งานแปรรูปทำได้หลากหลาย แผ่น HIP แผ่น HIP ย่อมาจากคำว่า High Impact Polystyrene พลาสติกที่มีความแข็งแรง ทนทานสูงเช่นเดียวกัน สามารถงอโค้งดัดได้ ลักษณะของพื้นผิวมีความเรียบ มันเงา พลาสติกชนิดนี้ปัจจุบันนิยมใช้ทำบรรจุภัณฑ์ต่างๆ […]

ระบบติดตามตรวจสอบเลขพัสดุหนึ่งในงานหลังการขายที่สำคัญที่สุด

การติดตามพัสดุภัณฑ์หรือการ ตรวจสอบเลขพัสดุ เป็นหนึ่งในงานหลังการขายที่สำคัญที่สุดในอีคอมเมิร์ซ โดยสิ่งสำคัญในอุตสาหกรรมอีคอมเมิร์ซ คือการที่บริษัทต่าง ๆ พยายามแข่งขันกันเพื่อดูว่ามีฟังก์ชันใดบ้างที่ช่วยทำให้ทำงานได้มากขึ้นและมีประสิทธิภาพดีกว่า และหนึ่งในการบริการที่ลูกค้าให้ความสำคัญมากที่สุด นั่นก็คือ ระบบติดตามพัสดุภัณฑ์สำหรับการขนส่งและการคืนสินค้านั่นเอง การ ตรวจสอบเลขพัสดุ มีความสำคัญต่อลูกค้าเป็นอย่างมาก อ้างอิงจากการศึกษาของ Statista เกี่ยวกับตัวเลือกการจัดส่งที่ได้รับความนิยมมากที่สุดในหมู่ผู้บริโภคจำนวนมาก คือ ระบบติดตามพัสดุ หรือ ตรวจสอบเลขพัสดุ ซึ่งได้กลายเป็นหนึ่งในปัจจัยหลักที่ลูกค้าต้องการ และการไม่ให้บริการนี้แก่ลูกค้า อาจส่งผลเสียต่ออัตราการแปลงและธุรกิจโดยรวมของคุณได้อย่างแทบไม่น่าเชื่อเลยทีเดียว การติดตามพัสดุภัณฑ์ หรือการตรวจสอบเลขพัสดุในธุรกิจอีคอมเมิร์ซคืออะไร? รหัสติดตามหรือการตรวจสอบเลขพัสดุ คือชุดของตัวเลขและตัวอักษรที่มีจุดประสงค์เพื่อใช้ในการติดตาม หรือตรวจสอบการจัดส่ง รหัสติดตามนี้จัดทำโดยผู้จัดส่งให้กับธุรกิจอีคอมเมิร์ซและลูกค้า เพื่อแจ้งให้ทราบถึงสถานะในการจัดส่ง สิ่งนี้ช่วยสร้างความรู้สึกโปร่งใสและความปลอดภัยสำหรับทั้ง 2 ฝ่าย การตรวจสอบเลขพัสดุ ช่วยเพิ่มประสิทธิภาพต้นทุนในอีคอมเมิร์ซลอจิสติกส์ การติดตามพัสดุภัณฑ์เป็นปัจจัยพื้นฐานในการนำมาวิเคราะห์ค่าใช้จ่ายที่เกี่ยวข้องกับลอจิสติกส์อีคอมเมิร์ซ เพราะวิธีนี้จะช่วยทำให้คุณพบจุดอ่อนในธุรกิจ เพิ่มประสิทธิภาพเส้นทางในการจัดส่ง และใช้ในการตรวจสอบโครงสร้างการจัดส่งพื้นฐานนอกจากนี้ การติดตามพัสดุภัณฑ์ยังช่วยทำให้องค์กรประสานงานและเชื่อมต่อกระบวนการภายในได้เป็นอย่างดี เช่น…การรับสินค้าหรือการเติมสต๊อก การดำเนินการนี้จะช่วยทำให้มีการดำเนินการตามคำสั่งซื้อได้เร็วขึ้น และส่งผลทำให้โลจิสติกส์อีคอมเมิร์ซมีประสิทธิภาพมากขึ้นตามไปด้วย เพิ่มมูลค่าให้กับลูกค้าด้วยบริการหลังการขาย เมื่อธุรกิจนำเสนอบริการคุณภาพสูงให้แก่ลูกค้า แสดงว่ามีความเอาใจใส่และสนใจที่จะมีความสัมพันธ์ที่ยาวนานกับลูกค้า ซึ่งสิ่งนี้ส่งผลต่อชื่อเสียงของบริษัทและ ROI ตามมา และนี่คือเหตุผลที่ธุรกิจจำนวนมากพยายามจัดสรรการทำงานใหม่ โดยมีจุดประสงค์นำเสนอการ ตรวจสอบเลขพัสดุ ให้กับลูกค้า เพราะการรักษาลูกค้ามีความสำคัญมากพอ ๆ […]

แอพสั่งของจากจีน ที่เชื่อถือได้

สำหรับบริการสั่งซื้อสินค้าจากจีนในปัจจุบันแน่นอนว่าได้รับความนิยมและเป็นที่ชื่นชอบไม่ว่าจะเป็นพ่อค้าแม่ค้าที่รับสินค้าจากจีนมาขายหรือจากนักช็อปทั่วไปที่เลือกจะสั่งซื้อสินค้าจากจีนมาใช้งานเองโดยในวันนี้เรามีแอพสั่งของจากจีนมาแนะนำให้คุณได้ลองเข้าไปทำความรู้จักเพื่อที่จะช่วยทำให้คุณสามารถเลือกซื้อสินค้าที่ต้องการจากประเทศจีนได้ง่ายมากขึ้นด้วยแอพสั่งของจากจีนที่เราจะแนะนำให้คุณได้รู้จักต่อไปนี้คือ Yourbaobao ซึ่งถือว่าเป็นแอปสั่งของจากจีนที่มาแรงที่สุดและเชื่อถือได้ด้วยเป็นบริการเมนูภาษาไทยทำให้คุณไม่ต้องเป็นกังวลในขั้นตอนการสั่งซื้อสินค้าจากจีนว่าจะเกิดความผิดพลาดหรือเกิดความไม่เข้าใจในการสั่งซื้อสินค้าทางค่ะสนใจจะเลือกใช้บริการแอพสั่งของจากจีนต้องเข้ามาทำความรู้จักและเลือกซื้อสินค้าผ่าน Yourbaobao ได้เลย บริการแอพสั่งของจากจีนกับ Yourbaobao เมื่อพูดถึงแอพสั่งของจากจีนในปัจจุบันก็ต้องยอมรับว่ามีหลากหลายแอปให้คุณได้ลองเข้าไปเลือกใช้บริการ แต่สำหรับ app สั่งของจากจีน Yourbaobao สั่งของจากจีนนับว่าเป็น แอพที่กำลังได้รับความนิยม และเป็นที่ชื่นชอบสำหรับผู้ที่สั่งซื้อสินค้าเป็นอย่างมาก เนื่องจากเป็นเมนูภาษาไทยทำให้ผู้สั่งซื้อสินค้าที่เป็นคนไทยเข้าใจในขั้นตอนการสั่งซื้อสินค้าได้มากขึ้นโดยไม่ต้องกังวลว่าจะเกิดความผิดพลาดในการสั่งซื้อสินค้าใดๆก็ตามดังนั้นในวันนี้ถ้าคุณเป็นคนหนึ่งที่คนอยากใช้บริการแอพสั่งของจากจีนแต่ยังตัดสินใจไม่ได้ว่าจะเข้าไปใช้บริการกับแอปไหนวันนี้ลองเข้ามาทำความรู้จักและเลือกใช้บริการกับ Yourbaobao ภายในแอปมีหลายแบบสินค้าให้คุณได้เลือกซื้อและแต่ละสินค้านั้นก็ช่วยทำให้คุณมีตัวเลือกกับสินค้าที่ดีมีคุณภาพถ้ามีการจัดการขนส่งที่เชื่อถือได้รวดเร็วคุณสามารถเลือกได้เองว่าจะเข้าไปรับสินค้าเองที่โกดังหรือว่าจะให้เราส่งสินค้าไปที่บ้านของคุณทั้งหมดนี้ขึ้นอยู่กับความต้องการของลูกค้าด้วยกันทั้งสิ้น สำหรับคนที่สนใจจะใช้บริการแอปสั่งของจากจีนก็ลองเข้ามาดูรายละเอียดเพิ่มเติมได้ที่หน้าเว็บก่อนที่จะสั่งซื้อเพื่อที่จะช่วยทำให้คุณเข้าใจในขั้นตอนและวิธีการใช้บริการแอปสั่งของจากจีนได้มากขึ้นโดยไม่ต้องกังวลว่าจะเกิดความผิดพลาดในการสั่งซื้อสินค้าในก็ตาม เอาไปให้ใครสนใจต้องการใช้บริการแอพสั่งของจากจีนแต่ยังตัดสินใจไม่ได้ว่าจะเข้าไปใช้บริการกับเว็บไหนแอปไหน Yourbaobao เราเป็นอีกหนึ่งตัวเลือกที่คุณไม่ควรมองข้ามเลยทีเดียวทั้งนี้หากคุณมีปัญหาในการสมัครเป็นสมาชิกหรือมีปัญหาในการสั่งซื้อสินค้าก็สามารถเข้ามาสอบถามกับทางทีมงานได้ตลอดเวลาเช่นเดียวกัน

4 เรื่องเกี่ยวกับแบตเตอรี่รถยนต์ที่คนขับรถควรรู้

หากเอ่ยถึงอุปกรณ์สำคัญสำหรับรถยนต์ คงหนีไม่พ้นแบตเตอรี่รถยนต์อย่างแน่นอน โดยหน้าที่ของเจ้าแบตเตอรี่หลักๆ ก็คือการจ่ายกระแสไฟฟ้าให้กับเครื่องยนต์ในส่วนต่างๆ นั่นเอง อย่างไรก็ดีคนขับรถหลายคนนั้นไม่เคยหาความรู้เกี่ยวกับแบตเตอรี่สักเท่าไรนัก เนื่องจากไม่ชอบเรื่องของเครื่องยนต์กลไก แต่เมื่อคุณขับรถยนต์แล้วการใส่ใจหาความรู้เกี่ยวกับแบตเตอรี่ก็เป็นสิ่งที่สำคัญเช่นกัน และเรื่องราวของแบตเตอรี่ที่คุณไม่รู้มีดังต่อไปนี้ 1. ควรเช็คแบตเตอรี่บ้าง หากว่าคุณเป็นอีกคนหนึ่งที่อยากให้การขับรถนั้นราบรื่นไปตลอด ขอแนะนำว่าให้เช็คแบตเตอรี่อยู่อย่างสม่ำเสมอ หากใครที่ไม่มีความรู้ในเรื่องของการเช็คแบตเตอรี่รถยนต์ คุณอาจเริ่มต้นด้วยการหาความรู้ในคลิปวิดิโอก่อนเป็นอันดับแรก เนื่องจากคลิปในยูทูปจะมีการไขข้อข้องใจตั้งแต่เริ่มต้นเปิดฝากระโปรงรถเลยทีเดียว 2. อายุการใช้งานของแบตเตอรี่ อีกหนึ่งสิ่งที่หลายคนยังไม่รู้ก็คืออายุการใช้งานของแบตเตอรี่นั่นเอง โดยแบตเตอรี่นั้นโดยทั่วๆ ไปจะมีการใช้งานราวๆ 3 ปีเท่านั้น ในระหว่างการใช้งานก็ต้องเติมน้ำกลั่นบ้าง แบตเตอรี่แบบเปียกจะมีสองแบบด้วยกัน ได้แก่แบบที่ต้องเติมน้ำกลั่นบ่อยๆ และแบบที่ไม่ต้องเติมน้ำกลั่นบ่อย แบบหลังจะดูแลได้ง่ายกว่าแบบแรก แทบไม่ต้องเปิดเติมน้ำกลั่นเลยก็ว่าได้ แต่ราคาอาจแพงพอสมควร 3. ข้อควรกระทำเมื่อแบตเตอรี่หมด สำหรับใครที่แบตเตอรี่หมด สิ่งที่คุณควรทำก็คือมองหาคนช่วยเหลือ อย่างไรก็ดีหากแบตเตอรี่หมดกลางถนน ก็ควรจะพยายามประคองรถเข้าไปริมถนนเสียก่อน จากนั้นจึงค่อยถามคนแถวๆ นั้นว่ามีใครสามารถจัมพ์แบตเตอรี่ได้บ้างหรือไม่ เมื่อจั๊มแบตได้แล้วก็ค่อยขับรถไปที่อู่เพื่อเปลี่ยนแบตเตอรี่ แค่นี้ก็ทำให้คุณปลอดภัยแล้ว 4. เลือกเปลี่ยนแบตเมื่อครบอายุการใช้งาน แต่หากว่าใครที่ไม่อยากให้ตนเองต้องไปเสี่ยงดวงบนท้องถนน ขอแนะนำเลยว่าให้คุณนั้นเลือกเปลี่ยนแบตเตอรี่เมื่อครบอายุการใช้งานเลยก็ได้เช่นกัน โดยปัจจุบันราคาของแบตเตอรี่ก็ไม่แพงสักเท่าไรแล้ว เมื่อเปลี่ยนแบตก็จะมั่นใจได้ว่ารถของคุณจะใช้งานได้อย่างยาวนาน ไม่เกิดปัญหากลางทางให้คุณต้องกังวลและกลุ้มใจอีกด้วย สำหรับการดูแลรถยนต์ถือเป็นสิ่งที่หลายๆ คนต้องใส่ใจอย่างยิ่ง เมื่อมีรถยนต์ควรรู้เรื่องรถบ้างไม่มากก็น้อย และไม่ควรปล่อยให้เป็นเรื่องของศูนย์เพียงอย่างเดียว เนื่องจากว่าเมื่อถึงเวลาที่รถเสีย คุณอาจโดนศูนย์เรียกเก็บเงินราคาแพงๆ ก็ได้เช่นกัน และนี่ก็คือเรื่องน่ารู้ของแบตเตอรี่รถยนต์ที่หลายๆ […]

หลักการเลือก รถยนต์มือสอง

รถยนต์มือสอง ถือได้ว่าเป็นรถยนต์ที่ค่อนข้าง ที่ได้รับความนิยมและมีความน่าสนใจ สำหรับผู้ที่มีกำลังทรัพย์ ไม่ค่อยมากการที่จะเลือก หารถยนต์สักคันเอาไว้ใช้สอย โดยไม่เสียเงินมากมายจนเกินไป แถมยังมีรถดีๆขับ ไม่ต้องตากแดด ตากฝน ตากลม ก็ต้องเลือกที่จะซื้อรถยนต์มือสองเท่านั้น จึงจะสามารถตอบสนอง ความต้องการของคน ที่มีกำลังค่อนข้างต่ำได้อย่างดีมากที่สุด ครั้นจะให้หาซื้อแต่รถยนต์มือหนึ่งนั้น ก็คงจะเกินตัวไป บางคนก็อยากจะได้ รถยนต์มือหนึ่งเช่นเดียวกัน แต่อาจจะทำให้มีปัญหาทางด้านการเงิน เพราะรายจ่ายมากเกินรายได้ หากว่าจะต้องเสียเงินให้กับ การซื้อรถมาขับจำนวนมากจนเกินไป จนต้องส่งค่างวดเยอะๆก็คงจะไม่ไหว ดังนั้นการเลือกซื้อรถยนต์มาใช้สักคัน โดยเป็นรถมือสองที่มีคุณภาพดี ไม่มีปัญหาในเรื่องของการใช้แล้วละก็ ก็ถือได้ว่าเป็นสิ่งที่ดีและเหมาะสม เป็นอย่างยิ่ง ถือได้ว่ารถมือสองจึงสามารถ ตอบสนองความต้องการของคน ที่มีภาระค่อนข้างเยอะ มีกำลังทรัพย์ค่อนข้างน้อย ได้เป็นอย่างดี แต่ทั้งนี้ทั้งนั้นการเลือก รถยนต์มือสองมาใช้สักคันนั้น หากไม่มีประสบการณ์ หรือไม่มีวิธีการในการเลือกที่ดี และเหมาะสมแล้วละก็ โอกาสที่คุณอาจจะได้รถ ที่ไม่มีคุณภาพหรือรถที่ซื้อมาซ่อม มากกว่าขี่ก็มีเช่นเดียวกัน ดังนั้นวันนี้เราจะมาแนะนำแนวทาง ในการเลือกดูรถยนต์มือสอง เพื่อให้ได้รถยนต์ที่ดีและมีคุณภาพ มาใช้สักคันตามมาดูกันดีกว่าว่า แนวทางในการเลือก เพื่อให้ได้รถยนต์ที่มีคุณภาพ และไม่มีปัญหาในเรื่องของ การใช้บริการนั้นเรามีหลักเกณฑ์ ในการเลือกอย่างไรบ้าง 1. หารายละเอียดของรุ่นและปีของรถที่ตนเอง ตั้งใจจะซื้อแน่นอนว่าในตลาดปัจจุบันนี้ มีรถมากมายหลากหลายรุ่น […]

5 ไอเดียตกแต่งภายในห้องรับแขกสไตล์ต่างๆ

ห้องรับแขกถือได้ว่าคือห้องซึ่งเป็นหน้าเป็นตาสำหรับเจ้าของบ้าน การตกแต่งภายในห้องรับแขกนั้นถือเป็นจุดสำคัญที่จะทำให้ผู้มาเยือนประทับใจ แต่อย่างไรก็ดีสำหรับคนที่อยากเริ่มต้นตกแต่งภายในห้องรับแขกด้วยตัวเอง ควรเลือกเอาไอเดียดีๆ มาประยุกต์ใช้ เพื่อให้ห้องรับแขกออกมาสวยตรงใจคุณมากที่สุด ซึ่ง 5 ไอเดียตกแต่งห้องรับแขกมีดังต่อไปนี้ 1.ใช้ภาพวาดประดับเพิ่มความสบายตา สำหรับสิ่งแรกที่หลายๆ คนไม่เคยนึกถึงมาก่อนเลยก็คือการใช้ภาพวาดสำหรับประดับในจุดต่างๆ เพื่อเพิ่มความสบายตาและสบายใจ ห้องรับแขกควรมีภาพวาดศิลปะจำพวกทิวทัศน์ ต้นไม้ ดอกไม้ เน้นการใช้โทนสีที่อ่อนหวานเป็นหลัก บางคนอาจเลือกรูปภาพที่เป็นมงคล เช่นภาพวาดปลาคาร์ฟ ภาพวาดดอกบัวก็ได้เช่นกัน 2.เลือกโซฟาตัวกว้างแทนชุดเก้าอี้ไม้รับแขก หากคุณต้องการให้บรรยากาศในบ้านมีความเป็นกันเอง ขอแนะนำว่าให้เลือกโซฟาตัวกว้างแทนที่จะเป็นชุดเก้าอี้ไม้ เนื่องจากโซฟาสวยๆ ที่บุดอกไม้ประดับบนผ้านั้นจะมอบความรู้สึกอบอุ่นให้กับผู้ที่มาเยือน แตกต่างจากการใช้ชุดเก้าอี้ไม้ที่ให้ความรู้สึกขึงขังและเป็นทางการมากจนเกินไป และที่สำคัญแท้จะทนทานสักเพียงใด แต่ราคาของเก้าอี้และชุดรับแขกไม้ก็แพงเกินความจำเป็นไปมาก 3.เติมความสวยงามให้ห้องรักแขกด้วยต้นไม้ฟอกอากาศ อีกหนึ่งวิธีการเสริมสร้างความงดงามให้กับห้องรับแขกของคุณก็คือการใช้ต้นไม้ประดับ ซึ่งปัจจุบันมีไม้ในร่มที่สามารถตกแต่งภายในห้องรับแขกได้สวยจนน่าอัศจรรย์ ที่สำคัญยังทนทาน เลี้ยงง่าย มอบความรู้สึกผ่อนคลายให้กับผู้ที่มาเยือน แตกต่างจากการใช้ต้นไม้ประดิษฐ์เป็นอย่างยิ่ง ประการสำคัญคือต้นไม้จริงนั้นราคาไม่แพงอย่างที่คิด แค่เพียงคุณนั้นเลือกขนาดกระถางที่เหมาะสมก็สามารถทำให้ห้องรับแขกนั้นน่าอยู่กว่าเดิมได้อย่างน่าทึ่ง 4.โคมไฟที่เข้ากับสไตล์ของห้อง การเลือกโคมไฟสวยๆ จะทำให้บรรยากาศในห้องรับแขกดูเปลี่ยนไปอย่างเห็นได้ชัด โดยคุณควรเลือกโคมไฟซึ่งเป็นโทนสีเหลืองนวล มอบความอบอุ่นและเป็นกันเองให้กับห้อง หรือบางคนอาจจะเลือกเป็นโคมไฟสไตล์วินเทจสำหรับเสริมสร้างบุคลิกของคุณเองก็ได้เช่นกัน 5.พรมตกแต่งห้อง พรมคือไอเดียอันแสนโดดเด่นในการตกแต่งห้องรับแขก ซึ่งในปัจจุบันนี้พรมราคาไม่แพงอย่างที่คิด เมื่อนำพรมมาปูในห้อง คุณจะพบว่าอารมณ์ของห้องเปลี่ยนไป จากความแข็งกระด้างก็กลายเป็นนุ่มนวลและอ่อนหวาน ทำให้ผู้มาเยือนรู้สึกไว้วางใจคุณมากขึ้น สำหรับใครที่กำลังมองหาไอเดียตกแต่งภายในห้องรับแขกอยู่ การเลือกใช้ไอเท็มเด็ดตกแต่งห้อง อย่างต้นไม้ฟอกอากาศ โซฟานั่งสบาย พรมสวยๆ […]

รวมเหตุผลที่คุณต้องทำความสะอาดกระจกสูง

กระจกคือเป็นวัสดุที่ได้รับความนิยมอย่างมากในระยะหลัง ๆ มานี้ เนื่องจากกระจกช่วยเสริมสร้างบรรยากาศในตัวอาคารให้ดูปลอดโปร่ง โล่ง น่าอยู่อาศัย แม้แต่ตึกสูงก็นิยมใช้กระจกเช่นกัน แต่ด้วยความที่กระจกบนอาคารสูงทำความสะอาดได้ยาก จึงทำให้เจ้าของตึกละเลยการทำความสะอาดกระจกสูง วันนี้จึงขอรวมเหตุผลที่คุณควรทำความสะอาดตึกสูงซึ่งมีดังต่อไปนี้ 1.ช่วยชำระล้างคราบสกปรก ในปัจจุบันนี้สภาพอากาศเลวร้ายลงเรื่อยๆ ทั้งฝุ่นจากการก่อสร้าง มลพิษจากท่อไอเสียควันดำของรถบนท้องถนน รวมไปถึงคราบโคลนสกปรกอันเกิดจากการรวมตัวกันของฝุ่นที่อยู่บนกระจกและน้ำฝน ส่งผลให้เกิดคราบเกาะติดฝังแน่นตัวกระจก หากไม่ได้รับการทำความสะอาดจะก่อให้เกิดผลเสียหลายประการ 2.เพิ่มประสิทธิภาพในการทำงานของผู้คนในอาคาร กระจกที่สะอาด สดใส จะเผยให้เห็นทัศนวิสัยอันแจ่มชัดมากยิ่งขึ้น ยิ่งหากเป็นอาคารสูงด้วยแล้ว กระจกทำหน้าที่เป็นตัวเสริมสร้างความคิดสร้างสรรค์ ทำให้สมองปลอดโปร่งและจิตใจผ่อนคลาย คงไม่มีใครที่อยากทำงานพร้อมๆ กับนั่งมองกระจกที่เต็มไปด้วยฝุ่นอย่างแน่นอน กระจกที่ใส ชัดเจน ผ่านการทำความสะอาดมาเรียบร้อยแล้วจะช่วยเพิ่มประสิทธิภาพของการทำงานได้ ดังนั้นเจ้าของบริษัทจึงไม่ควรละเลยการทำความสะอาดกระจกเป็นอันขาด 3.เสริมภาพลักษณ์ให้กับตัวอาคาร ภาพลักษณ์ดึงดูดความเชื่อมั่นของคนภายนอกได้เป็นอย่างดี เชื่อหรือไม่ว่าหากอาคารของคุณมีกระจกที่ขุ่นมัวและคราบสกปรก คนภายนอกจะไม่เชื่อว่าบริษัทของคุณทำงานได้อย่างมีประสิทธิภาพ การสร้างความเชื่อมั่นให้กับลูกค้าเหมือนถนนลาดยางที่กรุยทางให้ลูกค้าอยากติดต่อและทำธุรกิจกับบริษัทของคุณ การทำความสะอาดกระจกสูงจึงถือเป็นสิ่งที่สำคัญอย่างมาก 4.ลดการเสื่อมสภาพของตัวกระจก หากไม่ทำความสะอาดกระจกเป็นประจำจะไม่มีทางรู้เลยว่ากระจกมีการแตกร้าวหรือมีการชำรุดบริเวณใดบ้าง การทำความสะอาดกระจกจึงถือเป็นการบำรุงรักษาตัวกระจกได้อีกทางหนึ่ง เมื่อทำความสะอาดจุดใดแล้วพบสิ่งที่ต้องซ่อมแซมหรือแก้ไข จะสามารถซ่อมได้อย่างทันท่วงที 5.เพิ่มแสงสว่างในตัวอาคาร การเช็ดกระจกให้สว่าง แจ่มใส เป็นการเปิดรับแสงจากธรรมชาติให้เข้ามาในตัวอาคารอย่างเต็มที่ การเพิ่มแสงสว่างในตัวอาคารจะส่งผลให้คุณสามารถประหยัดไฟฟ้าที่ต้องเปิดในตัวอาคารได้ อีกทั้งยังทำให้บรรยากาศในอาคารสดชื่นมากขึ้นกว่าเดิมอย่างแน่นอน ข้อดีของการทำความสะอาดกระจกสูงมีหลายประการ ทั้งการเสริมภาพลักษณ์ต่อบุคคลภายนอก การบำรุงรักษากระจกไปในตัว การเพิ่มแสงสว่างในอาคาร ดังนั้นหากคุณเป็นเจ้าของธุรกิจ ถึงเวลาแล้วหรือยังที่คุณจะทำความสะอาดกระจกอาคารของคุณเอง

ทำความรู้จักกับบุหรี่ไฟฟ้า

บุหรี่ไฟฟ้าเข้ามามีบทบาทในชีวิตประจำวันปัจจุบันมากขึ้น เนื่องจากบุหรี่ไฟฟ้าถูกเคลมว่าสามารถใช้แทนบุหรี่ปกติทั่วไปได้ แถมปลอดภัยมากกว่าอีกด้วย แต่เอเจ้าบุหรี่ไฟฟ้านี้จะปลอดภัยกว่าบุหรี่ปกติธรรมดาจริงๆ หรือ บทความนี้ เรามาหาคำตอบจากส่วนประกอบของบุหรี่ไฟฟ้านี้กัน ว่าแล้วก็อย่ามัวเสียเวลา ลงไปอ่านพร้อมๆ กันเลย ส่วนประกอบของบุหรี่ไฟฟ้า ส่วนประกอบของบุหรี่ไฟฟ้า มีทั้งหมด 4 ประเภทด้วยกัน คือ ส่วนประกอบของบุหรี่ไฟฟ้า : นิโคติน เป็นสารเสพติดชนิดหนึ่งที่พบได้ทั้งในบุหรี่ไฟฟ้า และบุหรี่ปกติทั่วไป เป็นสารที่ทำให้ร่างกายเสพติดการสูบบุหรี่ ส่วนประกอบของบุหรี่ไฟฟ้า : โพรไพลีนไกลคอล เป็นส่วนประกอบในสารสำหรับการทำให้เกิดไอ ส่วนประกอบของบุหรี่ไฟฟ้า : กลีเซอรีน เป็นสารเพิ่มความชื้นที่จะผสมผสานกับสารโพรไพลีนไกลคอล องค์การอาหารและยา (FDA) ยืนยันถึงความปลอดภัยว่าใช้ได้ทั้งในอาหารและยา แต่ยังไม่ได้รับการยืนยันว่าเมื่อเปลี่ยนรูปแบบเป็นไอที่สูบหรือสูดแล้วเกิดผลกระทบอย่างไรต่อร่างกาย เช่นเดียวกันกับโพรไพลีนไกลคอล ส่วนประกอบของบุหรี่ไฟฟ้า : สารแต่งกลิ่นและรส เป็นสารเคมีที่ใช้กับอาหารทั่วๆ ไป ซึ่งมีความปลอดภัยเมื่อรับประทานเข้าสู่ร่างกาย แต่ยังไม่ได้รับการยืนยันว่าเมื่อเปลี่ยนรูปแบบเป็นไอที่สูบหรือสูดแล้วเกิดผลกระทบอย่างไรต่อร่างกาย ความอันตรายของสารนิโคติน VS สารโพรไพลีนไกลคอล และสาร Glycerol/Glycerin รู้หรือไม่ว่า สารนิโคติน สารโพรไพลีนไกลคอล และสาร Glycerol/Glycerin เป็นอันตรายต่อชีวิตมากๆ เพราะสารนิโคติน เมื่อเข้าสู่ร่างกายจะไปกระตุ้นระบบประสาทส่วนกลาง […]

การเช่ารถยนต์รายเดือนอีกหนึ่งทางเลือกสำหรับคนที่ยังไม่ต้องการรถยนต์

สำหรับคนที่มาพักผ่อนในต่างประเทศ หรือ มาจากต่างประเทศและกลับมาพักไทยเพียงชั่วคราวนั้นการเลือกเช่ารถยนต์นั้นเป็นอีกหนึ่งในตัวเลือกที่หลายคนมักจะมองหา ซึ่งการเช่ารถรายเดือนนั้นมีข้อดีมากมากด้วยเช่นกัน ดังนั้นในบทความนี้เราจะมาพูดถึง และ ทำความรู้จักกับ การเช่ารถรายเดือน มากกขึ้นนะครับ การเช่ารถรายเดือนคืออะไร ก่อนอื่นเรามาทำความรู้จักกับการเช่ารถรายเดือนก่อนนะครับ การเช่ารถรายเดือนนั้นคือ การเช่ารถในระยะกลาง อยู่ที่ประมาณ 1-3 เดือน ซึ่งทุกอย่างจะไปตามเงื่อนไขที่บริษัทกำหนดขึ้นมาในการเช่า โดยก่อนที่จะเช่านั้นมีการให้อ่านสัญญาก่อนที่จะเริ่มเช่านะครัย ใครเหมาะกับการเช่ารถรายเดือน สำหรับคนที่เหมาะสำหรัยการเช่ารถรายเดือนนั้นคือ คนที่พึ่งกลับมาจากต่างประเทศ และ ต้องการอยู่ที่ประเทศเพียงแค่ชั่วคราว หรือคนที่ต้องการมาทำงานในระยะสั้น ๆ ในต่างจังหวัด แต่จะต้องใช้รถยนต์ในการขนส่ง หรือ เดินทางเอง การเลือกใช้บริการเช่ารถยนต์รายเดือนเองก็ดูเหมาะสมนะครับ เรื่องที่ต้องระวังในการเช่ารถรายเดือน โดยส่วนมกานั้นข้อดีคิดว่าที่อื่น ๆ คงบอกไปหมดแล้ว แต่สำหรับผมเราจะมาพูดถึงข้อควรระวังในการเลือกใช้บริการเช่ารถรายเดือนนะครับ โดยข้อควรระวังนั้นมีเพียงไม่กี่ข้อนั้นคือ 1. เมื่อรถเกิดอุบัติเหตุแล้ว ลองถามทางบริษัทว่ามีประกันภัยให้หรือไม่ ? หรือถ้าไม่มี แล้ว ประกันภัยรถยนต์นั้นชั้นอะไร และ คุ้มครองสูงสุดกี่บาท และ อีก 1 นั้นคือในเรื่องของรถที่เข่ามาหายไปนั้นเราจะต้องทำอะไรบ้าง หรือ จะต้องจ่ายค่ารถยนต์ที่หายตามมูลค่าของรถยนต์คันนั้นหรือไม่ ดังนั้นสำหรับใครที่ต้องการจะเช่ารถรายเดือนนะครับ ถึงแม้จะเป็นรถเช่า แต่แน่นอน ว่าระยะเวลาที่อยู่ด้วยกันกับรถนั้น […]